The profitability of artificial and natural regeneration: A forest investment comparison of Poland and the U.S. South

The profitability of artificial and natural regeneration: A forest investment comparison of Poland and the U.S. South

Rafal Chudy,a,* Frederick Cubbage,b Jacek Siry,c and Jacek Chudy a

a: Forest Business Analytics, Łódź, Poland;

b: Department of Forestry and Environmental Resources, North Carolina State University, Raleigh, NC, USA;

c: Warnell School of Forestry and Natural Resources, University of Georgia, Athens, GA, USA.

*Corresponding author: E-mail: rafal@forest-analytics.com

Citation: Chudy R., Cubbage F., Siry J., Chudy J. 2022. The profitability of artificial and natural regeneration: A forest investment comparison of Poland and the U.S. South. J.For.Bus.Res. 1(1):1-20.

Received: 30 March 2022 / Accepted: 11 April 2022 / Published: 21 April 2022

Copyright: © 2022 by the authors

ABSTRACT

The historical development of silviculture has been closely related to an increasing need for timber, which resulted in more planted forests and artificial regeneration over time. The idea of natural regeneration through shelterwood cutting was often not accepted by forest owners as a management practice because of inadequate financial returns and less certain outcomes. Despite the evolving dominance of planted forests, questions remain if the lower costs of natural regeneration may still provide sufficient profitability of forest investments. In this paper, the profitability of planted versus natural forest management in Poland and the U.S. South was examined. A discounted cash flow model was developed to evaluate the profitability of artificial and natural regeneration in hypothetical Scots and loblolly pine stands in Poland and the U.S. South, respectively, and hardwood stands (dominated by oak spp.) in both countries. The results have shown that for both countries and species, natural regeneration regimes produce higher internal rates of return (IRR), largely due to less expensive establishment costs. The largest difference in returns is observed for hardwood in the US South (97 basis points, bps, or almost 1 percentage point), followed by pine in the US South (84 bps) and pine and hardwood in Poland (both ca. 70 bps). Southern pines in the U.S. South may have larger net present values (NPV) at moderate discount rates, as well as provide more certain wood production outcomes, which have contributed to their pervasive adoption. We conclude that natural stand forest management, in addition to better rates of return, may bring other non-financial benefits (e.g., genetic diversity, resilience), which may support forest owners and the environment, especially under changing climate conditions. Nevertheless, the regeneration method and its feasibility and profitability should be carefully considered on a case-by-case basis for each forest investment.

Keywords: regeneration, silviculture, forest investments, profitability, IRR

INTRODUCTION

The historical development of silviculture has been closely related to an increasing need for timber, which since the Middle Ages progressed from exploitation and high grading to selective natural stand management to planted forests and artificial regeneration (Chudy and Cubbage 2020). Planting softwoods to increase yields and gain a higher total profit spread first over most of Europe and then influenced forest management methods in the rest of the world (James 1996). Until the turn of the 20th century, even-aged planted stands oriented for timber production also have dominated the research and practical business applications around the globe.

Once managed through an integrated conservation model, global forest management has evolved into a bifurcated system of timber plantations and areas managed for multiple purposes, such as recreation, hunting, range, and wilderness (Bennett 2015). Both increasing demands for wood and timber products and agricultural lands contributed to the adoption of the bifurcated system, raising several global concerns in the process. The return to purposeful natural forest management has been one middle alternative to these two ends of the forestry spectrum.

Forest health problems, social opposition, and forest certification standards have caused the forestry sector to reconsider its preference for planted even-aged monocultures. New proposals have occurred for more natural systems of regeneration, reduction of clear cuts areas and the cultivation of mixed forests to maintain natural forest structure. The high demand for wood during the Second World War and the post-war years caused an extreme deterioration of forest cover. According to Johann (2006), this was probably why a considerable number of Central-European foresters promoted the cultivation and conservation of natural-mixed stands, natural regeneration through shelterwood cutting or continuous cover forestry systems or thinning the cultivation of the growing stock. However, forest owners often did not accept such ideas as management practices because of less certain success of natural stand management and perhaps poorer financial returns.

The economic costs and returns, together with the possible harvest and regeneration alternatives acceptable for the site, and the landowner’s management objectives, significantly influence the regeneration decision (Cubbage et al. 1991). Natural regeneration is intended to (a) lower initial costs, (b) maintain genetic potential, (c) offer a rich choice of species, and (d) ensure unharmed root development. Despite the historical preference for planted forests by many large forest owners and forest managers, questions remain if the lower costs of natural regeneration may still provide sufficient profitability for forest investments. This issue depends on the costs and success of planted and natural forest management, tradeoffs between maximum wood quantity and diverse ecosystem services, the capital budgeting criteria used (e.g., Internal Rate of Return (IRR) versus Net Present Value (NPV)), capital availability, landowner and social preferences, climate change, and more.

Only a few studies have made economic comparisons between natural and artificial regeneration[1] in Poland or the U.S. Długosiewicz et al. (2019) compared the costs of establishing and maintaining Scots pine (Pinus sylvestris) stands using natural and artificial regeneration methods in south-eastern Poland. They found that the total costs of artificial stand regeneration and tending were on average higher by USD 376/ha than naturally regenerated stands. Kaliszewski (2018) did a cost analysis for artificial and natural oak (Quercus spp.) regeneration in selected forest districts in Poland. Similarly, the results showed that the total costs of silvicultural and protective measures in natural oak regeneration were considerably lower (ca. USD 1,387/ha) compared to artificial regeneration. It was found that lower costs of natural oak regeneration were the consequence of the complete lack of expenditures on seedlings and planting, but also a considerably lower weeding intensity, infrequent supplementary planting, and the absence of mechanical wildlife damage control measures.

In the United States, Dangerfield and Edwards (1991) compared the profitability between natural regeneration and planted stands of loblolly pine (Pinus taeda). It was found that natural loblolly regeneration was financially competitive with a clearcut-and-plant method. Cubbage et al. (1991) also showed that the natural regeneration (seed-tree method) was the most profitable for longleaf pine (Pinus palustris) based on the capital budgeting criterion of internal rate of return (IRR) compared to even high-intensity site preparation and planting regime in the U.S. South. However, these findings were challenged by practitioners, who stated that natural regeneration often looked good on paper, but seldom did so on the ground. Indeed, historical evidence in the U.S. South suggests that planted pine forests are increasingly preferred. They increased from about 4 million ha in 1970 (Prestemon and Abt 2002) to more than 17 million ha by 2012 (Oswalt et al. 2014). Planted forests have been adopted almost exclusively by all professional forest asset managers (e.g., timber investment management organizations (TIMOs), real estate investment trusts (REITs) or wood industry), as well as a large share of nonindustrial private forest owners.

Unfortunately, most previous studies are dated, limited to the regeneration phase only, or have not explicitly analyzed the profitability of different regeneration methods using discounted cash flow (DCF) and capital budgeting measures for forest investments using modern forest management approaches and data. In addition, previous studies did not explicitly consider the important influence of the selection of capital budgeting criteria – IRR, NPV, land expectation value (LEV), or benefit cost ratio (BCR) – and the impact on the likelihood of regeneration success and capital availability in the selection of planted versus natural stand management. We posit that (1) it is quite possible that natural regeneration may have high rates of return since it often does not require as much initial investment and that (2) planted forests with high costs but predictable large yields on a smaller land area may generate greater present values if adequate capital is available for establishing the plantation and the discount rate is low enough.

In fact, very few studies have systematically analyzed comparative planted and natural stand forest management economics and investment returns. However, this subject bears more examination now as social, environmental, genetic, and climate factors have raised questions about the long-term viability of planted monocultures.

Our objective here was to perform some contemporary, relevant analyses that examined this issue of planted versus natural forest management, using Poland and the U.S. South as case studies. Poland represents forests quite typical of Central Europe, and the U.S. South is the largest industrial roundwood producer in the world. These northern hemisphere countries are interesting because they still have opportunities to produce timber and nontimber products with native or naturalized trees, which are different from the cases of countries whose commercial planted forests usually consist of exotic species. The regions of the U.S. South and Europe and the species of oak (Quercus spp.), loblolly pine and Scots pine (Pinus sylvestris) are probably the most important species in the northern hemisphere, and perhaps in the world, for their extensive mix of major commercial timber production and provision of many ecosystem services.

This research effort addresses this gap in the current research using a well-established DCF framework (Cubbage et al. 2014; Cubbage et al. 2020) for representative pine and oak stands in Poland and the U.S. South. The paper continues with a description of the methods and data applied. Then the results are presented and discussed, and finally, the principal conclusions are drawn.

MATERIAL AND METHODS

Input Data for Poland

Since forestry in Poland is dominated by State Forests National Forest Holding (State Forests) (Siry and Newman 2001; Chudy et al. 2016), no consulting forestry firms have such cost data readily available in their records. Therefore, for Scots pine management, we obtained data on costs from two independent sources: literature[2] and estimate of a local expert, and we averaged them. Concerning site preparation, planting and periodic stand treatment for Scots pine, natural regeneration costs were lower than artificial ones by 7%, 79% and 40%, respectively. Site preparation and planting costs (including replanting) for oak sp. were 90% lower for natural regeneration (127 USD/ha) than for artificial one (1,174 USD/ha).

Regarding growth and yield, we applied the mean annual increment (MAI) equal to 9.3 m3/ha/year for pine and 8 m3/ha/year for oak (BULiGL 2020). Since in Poland the rotation length is based on the biological rotation age[3] rather than the economic one[4], we assumed the same rotation age for both regeneration methods, i.e., 100 years for pine and 120 for oak.

We kept harvest and management costs[5] equal for both species groups to focus on the regeneration method purely. Therefore, forest tax in 2019 was equal to 11 USD/ha/year, and it is applied to forest stands older than 40 years (Kancelaria Sejmu 1991). Pulpwood and sawlog prices came from Forest and Timber Portal (Portal Leśno-Drzewny in Polish) (State Forests 2019), while fuelwood prices were obtained from Polish Statistical Office – GUS (Statistics Poland 2019).

The natural regeneration scenario assumed even-aged management such as seed tree or shelterwood method. For the physical and financial analysis, this helps to set the initial year to zero. Otherwise, for uneven management, the determination of the initial year would be difficult (Cubbage et al. 1991). All the costs from the literature that were reported in previous years were adjusted by Consumer Price Index (World Bank 2019) to make them equal to 2019 costs. For Poland, all costs were obtained in Polish Zloty (PLN) and were converted to United States Dollar (USD) by the following average 2019 conversion rate: 1US$ = 3.84 PLN (FRED 2019).

Input Data for U.S. South

Data for the U.S. South were obtained from prior research, secondary sources, and consultation with forest land managers. U.S. South management regimes for planted pine were taken from (Cubbage et al. 2020). Natural pine and both natural and planted hardwood regimes for planting, timber stand improvement, thinning, and final harvests were determined from interviews with forest managers. Rotation ages for typical stands modelled for the U.S. South were 25 years with one thinning for loblolly pine and 60 years with two thinnings for natural oak hardwoods. Unlike Poland, which has mandated biological rotation ages, the U.S. rotations equal the approximate financial optimum rotation ages[6].

Based on what has occurred in practice, these rotation ages and management regimes modelled in the U.S. South and Poland assumed largely even-aged management in both natural and planted stands. For example, in 2002, North Carolina had a forest area of 7.2 million ha, with 2 million ha of softwood/pine types and 5 million ha of hardwoods. From 1990 to 2002, 89% of all planted pine harvests were from even-aged forests, and only 11% were from partial harvests or commercial thinnings. In addition, even for natural pine, 82% of all harvests were from even-aged stands. For natural upland hardwoods[7], 68% of all harvests used even-aged methods. In aggregate, more than 75% of all North Carolina timber harvests resulted from even-aged methods (Brown 2004)[8].

We estimated average growth rates based on the U.S. Forest Service, Forest Inventory and Analysis data, drawn from a special run made by Sheffield (personal communication, 2020). These data summarized average growth rates for loblolly pine by state, and were used to estimate a representative southern growth rate for natural pine with good growth rates of 10 m3/ha/year and greater 13.5 m3/ha/year for artificial regeneration. The data from Sheffield also were used for hardwood species by state, for a mix of species types, including oak. We only had relevant growth rates for mixed oak-hickory hardwood types, which we used as the base. We also had a prior study by Siry et al. (2004), which had average growth rates of 2.1 tons per acre (4.1/m3/ha/year) for natural hardwood stands. We assumed that planted, well-spaced (3m x 3m) planted oak stands would yield 50% more than natural mixed natural stands or 6.2 m3/ha/year.

Stand site preparation, planting, and timber stand improvement data were taken from the North Carolina Forest Service (2020) prevailing rates cost reference for pine and hardwood. Stand administration costs were updated from Cubbage et al. (2020). Timber stumpage prices were based on TimberMart-South (2020) data. We estimated all management costs and timber sale prices for stumpage – the price of timber sold standing in the woods. Both in Poland and the U.S. South, we assumed that the selected species have good growth and management practices and represent typical sites with the most likely timber rotation and thinning regimes. These typical stands and management assumptions rest on similar analyses by (Cubbage et al. 2014; Cubbage et al. 2020).

The extensive input data, including treatment costs, timber prices, and cash flows for Poland and the U.S. South and the spreadsheets developed are not listed here but are available on request. The discounted values of those cost and return components are shown below in Figure 1.

Discounted Cash Flow (DCF) Model

We used a DCF model[9] for the analysis, which is usually used to evaluate forest investment opportunities. The approach and the data collection spreadsheet are similar to methods used before (Cubbage et al. 2014; Chudy et al. 2020; Cubbage et al. 2020) and have been proven robust, accurate, and sensitive to changing input prices and timber prices by product classes. The DCF model was used to calculate the NPV, LEV, IRR, and BCR for each regeneration method. The higher IRRs for a forest investment, and the greater the amount by which it exceeds the cost of capital, the higher the discounted net cash revenues compared to the expenses.

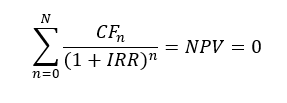

The IRR is the discount rate at which the net present value of all cash flows from a particular investment equals zero, defined by Equation 1 below.

Equation 1

where: CF0 – initial investment, CF1, CF2…CFN – net cash flows, NPV – net present value of the discounted costs and discounted benefits, IRR – internal rate of return, index n = 1, 2, 3, …N.

Net cashflow is calculated as the difference between total annual revenues and total operating expenses. For IRR calculations, we used the Excel IRR function. If there is an exceptionally variable set of cash flows with changes in their sign, which is common in natural forest stand analyses, the IRR function will not work – giving multiple roots. But the IRR can be calculated iteratively in a spreadsheet by comparing discounted costs and discounted revenues with different discount rates until they are equal, and thus NPV = 0.

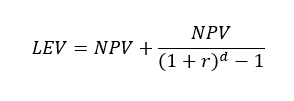

Since we cannot compare NPV of two different management forestry regimes due to their different rotation ages, we calculated and reported LEV, assuming these regimes are repeated in perpetuity, using the following formula:

Equation 2

where,

r - real discount rate (5%[10] for both Poland and the U.S. South), and

d – rotation age (specific for each species management regime and country).

We also report the BCR that is calculated as the total discounted benefits divided by total discounted costs within the lifetime of one rotation.

RESULTS

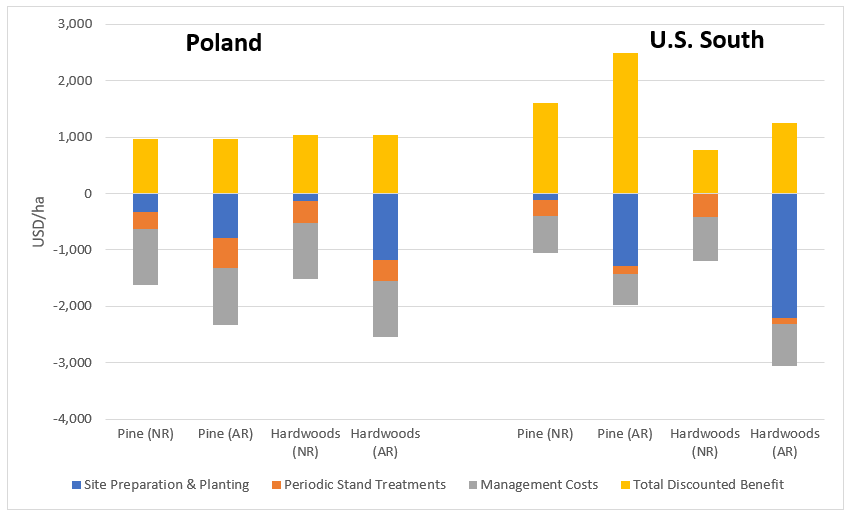

Figure 1 presents total discounted costs and benefits for both regeneration methods in pine and hardwoods stands in Poland and the U.S. South.

Figure 1. Discounted costs and benefits for pine and hardwoods in Poland and the U.S. South under natural and artificial regeneration regimes ($/ha). Note: NR – Natural Regeneration, AR – Artificial Regeneration

A few observations can be made about Figure 1. Site preparation and planting costs were significantly lower for natural regeneration methods than artificial ones in Poland and the U.S. South. Costs of natural regeneration were 60% and 91% lower than artificial ones for pine in Poland and U.S. South, respectively. The differences were even higher for hardwoods, and the cost reduction under natural regeneration was 89% and 100% lower, respectively. Regarding periodic stand treatments, the natural regeneration method costs were higher in both countries and species, except pine in Poland.

In Poland, for both species and regeneration methods, management costs were assumed to be equal as the rotation ages under both species’ regimes were the same. However, since the rotation ages for artificial regenerations (both pine and hardwoods) were shorter than naturally regenerated stands, the management costs in the U.S. South differ slightly.

In Poland, total discounted benefits (net incomes from thinnings and final harvest) for pine and hardwoods were similar despite the differences in growth rates and rotation ages. However, in the U.S. South, the benefits associated with pine were significantly higher than for the hardwood stands.

Table 1 presents the key financial metrics based on the discounted cash flow analysis for pines and hardwood management systems in Poland and the U.S. South.

Table 1. IRR, LEV, and BCR for natural regeneration and tree planting for pine and hardwood management systems in Poland and the U.S. South.

|

Financial parameter |

Natural regeneration |

Tree planting |

||

|

IRR |

Pine |

Hardwood |

Pine |

Hardwood |

|

Poland |

3.55% |

4.39% |

2.86% |

3.69% |

|

US South |

7.14% |

3.83% |

6.30% |

2.86% |

|

LEV ($/ha) |

|

|

|

|

|

Poland |

-666 |

-487 |

-1,369 |

-1,515 |

|

US South |

681 |

-414 |

722 |

-1,901 |

|

BCR |

|

|

|

|

|

Poland |

0.59 |

0.68 |

0.42 |

0.41 |

|

US South |

1.53 |

0.65 |

1.26 |

0.41 |

Note: Real discount rate of 5%.

For both countries and species, natural regeneration regimes produced higher IRRs. The most significant difference in returns was observed for hardwood in the U.S. South (97 basis points, bps[11]), followed by pine in the U.S. South (84 bps) and pine and hardwood in Poland (both ca. 70 bps). However, at the 5% discount rate, planted loblolly pine had a slightly higher LEV than the natural stands. Capital budgeting theory recommends that investors choose the highest NPV or LEV at a known discount rate to maximize their returns, rather than selecting the highest IRR, which does not account for the magnitude of the net profit. In practice, our calculations of the differences in southern pine LEVs were relatively small, and the differences in IRRs were modest.[12]

The LEV was the highest for pine stands in the U.S. South, and the difference between natural and artificial regeneration methods was relatively small (ca. 40 USD/ha). Then, the hardwood stands regenerated naturally in Poland, and the U.S. South had the second-highest LEV (albeit still negative at 5%), followed by naturally regenerated pines in Poland. Finally, artificially regenerated pines in Poland and hardwoods in Poland and the U.S. South had very negative LEVs due to significantly higher upfront site preparation and planting costs and relatively long rotation ages. The BCR showed the same outcome.

DISCUSSION AND IMPLICATIONS

Research Findings

We analyzed the financial returns of natural versus planted pine and hardwood forests for timber production using representative case studies from Poland in Europe and the U.S. South using the DCF approach and the primary capital budgeting criteria. The analysis provides insights about financial outcomes and tradeoffs of natural versus planted forests when there is much debate about their relative merits for broader goods and services such as biodiversity, carbon storage and social well-being. In addition, natural regeneration may lead to enhanced forest protection, survival and longevity, especially with a changing climate.

In this research, we have shown that based on the criterion of IRR, natural regeneration may lead to similar or even better financial results for forest owners compared to tree planting, which evolved to dominate actively managed forestry practices over the past centuries. The results of DCF models and analyses for the two countries, with different climatic conditions and forestry management settings, showed that natural regeneration regimes for pines and hardwoods always produced higher IRRs, primarily due to the low capital requirements and smaller initial establishment costs. However, at a reasonably low and prevalent real discount rate of about 5%, the preferred capital budgeting criterion of LEV was maximized by a small amount with pine plantations in the U.S. South.

Our models represent current input costs, timber prices and yields and use reasonable assumptions. Chudy et al. (2020) tested various ranges of input parameters under the Monte Carlo simulation framework for single-hectare financial models to examine the main factors that influence IRRs in several global timber plantation investment opportunities. They found that Poland’s IRRs for pine and oak stands were affected most by growth rates, management costs, and log prices (pulpwood price for pine and sawtimber price for oak). Site preparation cost was the least important for Scots pine, but it was among the top four most crucial parameters for oak stands. For loblolly pine in the U.S. South[13], the largest impacts were growth rates, sawtimber price and site preparation cost.

Although site preparation and planting costs are essential for the profitability of forest investments in Poland and the U.S. South, it is challenging for forest managers to reduce them. Nevertheless, natural regeneration can significantly help here, from a financial perspective and perhaps by providing more resilience to biotic and abiotic risk factors.

These and other results indicate that forest management costs in Polish State Forests could be optimized (or reduced), which should be pursued (Siry and Newman 2001; Chudy et al. 2016). For instance, State Forests in Poland plant between 8-10 thousand seedlings per hectare, explaining that such artificial regeneration resembles natural outcomes. The question arises if there is a need to replicate nature when the regeneration solution is at one’s fingertips – free of charge. That may be one of the reasons why periodic stand treatment costs for Scots pine in Poland are higher for tree planting than for natural regeneration (in all other models, the case was the opposite).

Lula et al. (2021) analyzed the profitability of Scots pine stands in southern Sweden and found that high-density planting (10,000 seedlings per hectare) resulted in a negative LEV, while planting on clear-cuts with 1,600 - 3,265 seedlings per hectare resulted in the highest profitability and production. The negative LEV for high-density planting confirms our results. Therefore, one recommendation for State Forests in Poland could be to either reduce the planting density or shift to natural regeneration practices where possible.

The results indicate that hardwood IRRs and LEVs were relatively close for natural regeneration in Poland and the U.S. South. Still, planting was much less profitable in the U.S. South and worse than natural management. For example, planting hardwood trees and waiting 50 or 120 years for returns leads to low IRRs and negative LEVs at a 5% or even a 3% discount rate. On the other hand, natural regeneration of loblolly pines can yield the highest IRR of 7.14%, but planted pines had the highest LEV of all management regimes, at $722 per hectare with a 5% discount rate.

These findings for the U.S. South reflect the management choices commonly made in the region. As of 2012, there was a surprisingly large area of 2.6 million ha of planted hardwoods and 64.7 million natural hardwood species in the U.S. South. Southern pine area included 17 million ha of planted pines and 19 million ha of natural regenerated pines (Oswalt et al. 2014). Most of the planted hardwoods in the U.S. South were prompted by federal and state incentive programs with broad ecosystem service goals. The relatively balanced mix of southern pine artificial and natural stands probably reflect the objectives of commercial owners with large amounts of capital who favor planted species, more predictable growth and yield outcomes, and reliable returns with somewhat higher LEVs, versus smaller and capital-constrained nonindustrial owners who often prefer spending less for forest establishment costs, but still can receive quite good IRRs.

The caveats on good regeneration and suitable species, however, are crucial. For example, only 55% of the 59 million ha of hardwoods in the U.S. South are valuable oak-hickory forest types. While the other 45% of hardwood forest types (e.g., gums, elms, and maples) (Oswalt et al. 2014) undoubtedly provide valuable ecosystem benefits, they will not offer very attractive financial returns. And even good management of oaks is far from likely, with degraded stands far outnumbering high-quality stands. So our results probably represent the upper bound of financial opportunities for hardwood species returns in the Northern Hemisphere. Pine stand returns also are probably much more predictable for planted stands than for natural stands.

While they are based on two countries, two species and deterministic DCF models, we believe that the results are broadly generalizable. First, other than planted hardwood forests in the U.S. South, the forest management models used are the most common in each country and each species, including mandated rotation ages in Poland and typical even-aged financial rotations in the U.S. South. Second, the results conform with intuition, suggesting that natural stand management with much lower initial costs could have higher IRRs if timber yields are reasonable. Our results also indicate that short-rotation planted pines are slightly preferred using LEV at sufficiently low discount rates, with higher net present values than natural stands. Third, the limited prior research on forests in the U.S. South found similar results, with natural forest investments having higher IRRs than planted forests (Cubbage et al. 1991; Dangerfield and Edwards 1991). Fourth, the direction of the comparative results we found would remain the same as long as relative input costs were the same for planted or natural stands, assuming timber prices were constant. This also seems likely, since as Chudy et al. (2020) noted, site preparation costs are not expected to be reduced much – still favoring natural regeneration. Last, the one factor that could reduce or reverse natural stands’ comparative advantage is the possible prospect of poorer yields from natural stands. This belief and outcome is undoubtedly a critical factor in the widespread conversion of natural to planted stands throughout Europe and the U.S. South.

Global Forest Resource Management Implications

Historically, the financial success of plantations and the ability to manage them to achieve more consistent and predictable results led to pervasive changes in forest structure and composition, favoring fast-growing conifers while eliminating broadleaved species from the 1860s onwards. Depending on the country, either the reduction of usual rotations and initial stocking density took place (Möhring 2001) or forestry was focused on predictable maximum sustained yield, technical wood product criteria, and more consistent management prescriptions and outcomes. Natural stand management may have been more desirable with scarce capital. Still, variation in regeneration success and different stand outcomes from natural management were immense due to factors such as the weather at crucial times, competition from undesirable species, the lack of seed or coppice trees, or having too much regeneration, which then requires expensive pre-commercial thinning.

Planted forests may be more expensive initially but usually ensure more consistent and predictable management and harvesting costs and greater timber growth and yield. In addition, management of planted forests allowed a reductionist scientific and educational approach to prevail, required fewer foresters and managers, and reduced administration costs, perhaps at the loss of the art of silviculture. In any case, ecosystem services did not receive much consideration in forest management (e.g., Johann 2006). Also, at the end of the 19th century, the introduction of fast-growing broadleaved species of Eucalyptus spp. and Acacia spp. accelerated the trends to faster-growing monocultures, especially in the Southern Hemisphere and tropics, which have even begun to replace some conifer plantations.

However, the higher profits and less variability in outcomes associated with monocultures also brought risks of less genetic diversity and perhaps less resilient forests, especially in times of climate change. These issues took decades to appear, and tree breeders actively try to ensure diverse genetic mixes. Nonetheless, the extensive monocultures and changing climate have resulted in more risk of damages from wind, insect outbreaks, or drought (e.g., bark beetle problem in Norway spruce in Central Europe or Chalara rust attacking European ash). Climate change and natural disasters such as major storms and hurricanes also have increased, which may be more likely to damage or destroy fast-grown, uniform, planted forests compared to more diverse natural forests. On the other hand, excessively old natural forests carry significant mortality risks due to less vigor and management, such as the massive outbreaks of mountain pine beetles and record wildfires in Western Canada and the U.S.

Many sectors of society have grown to oppose monocultures for their perceived problems that cause reduced wildlife habitat and biodiversity, harm to native and indigenous people, and adverse impacts on water quality and quantity. These objections have led to government responses to encourage natural forest management and the incorporation of criteria and indicators for forest certification to measure and encourage natural stand management and retention of natural forests. In addition, both major global forest certification systems – Forest Stewardship Council and Programme for the Endorsement of Forest Certification – encourage retention and protection of high conservation (natural) forests, as well as retention of woody biomass and snags after timber harvests, diverse age classes with multiple levels in forests, and variegated natural landscapes (Kuuluvainen et al. 2019; Gustafsson et al. 2020; Paluš et al. 2021). Certification states economic profitability as one of the three broad goals along with social and environmental goals, but the effects of such natural stand approaches have not been evaluated explicitly.

CONCLUSIONS

Our results provide more current information about the comparative financial returns for oak and pine forests with artificial and natural regenerations in the U.S. South and Central Europe. With the demand for more natural regeneration to provide more natural forest ecosystem benefits, these financial results are essential. Interestingly, the results indicate that if natural stand regeneration occurs well and commercially desirable species are produced, natural systems are financially similar or superior to planted forests.

Natural regeneration is certainly the first step toward nature-based silviculture. Therefore, we suggest that future research focus on models exploring the financial viability of other close-to-nature silvicultural practices, resulting in a predominantly uneven-aged, multi-layer and multi-species structure of forests. One such practice can be continuous cover forestry, which may bring a lot of challenges related to input parameters such as growth and yield, operations timing, costs and revenues estimations, and stand damage impact due to multiple entries.

Another direction for future research is implementing carbon accounting schemes into forest investment models. The voluntary carbon market mechanisms are already in place. Still, there is a need to understand better how different silvicultural regimes may affect the profitability of forests managed for carbon and/or timber. For instance, Evans et al. (2015) found that the average minimum carbon price required to make assisted natural regeneration viable was 60% lower than needed to make environmental plantings viable. It was concluded that assisted natural regeneration could sequester 1.6 to 2.2 times the amount of carbon sequestered by environmental plantings over a range of hypothetical carbon prices with a moderate 5% discount rate.

Forests are expected to play a substantial role in climate change mitigation efforts and other ecosystem services. Our financial research shows that, in theory, with successful forest management, forest owners and managers may receive similar investment returns to planted forests by taking the nature-based silviculture pathway that helps to reduce regeneration costs without affecting the further development of forest stand. However, our results cannot be indiscriminately extrapolated to other locations. Like almost all forest investments, a careful and diligent analysis should be performed on a case-by-case basis before making any silvicultural decisions and investments. If the forest owner’s analysis shows that it is feasible to achieve the same outcome with minimum resources used, like in our example with natural regeneration, such economic principles should be considered. Overall, the analyses here do extend our knowledge of planted versus natural forest investments and clarify some of the likely financial tradeoffs that should be considered in forest investments for commercial timber products as well as broader social goods and services.

ACKNOWLEDGMENTS

We are grateful to two reviewers for their valuable and insightful comments.

CONFLICT OF INTERESTS

The authors declare no conflict of interest.

REFERENCES CITED

Adamowicz K, Kaciunka H. 2014. Evaluating variation in logged timber costs and raw timber prices during the period, 2001-2009, for the Regional Directorate of the State Forests in Zielona Góra. Lesn Pr Badaw. 75(1):55–60. doi:10.2478/frp-2014-0006.

Ankudo-Jankowska A, Tutka A. 2014. Ocena ekonomicznej efektywności zabiegów trzebieżowych w drzewostanach sosnowych na przykładzie Nadleśnictwa Bogdaniec [Assessment of the economic effectiveness of thinning treatments in pine stands on the example of the Bogdaniec Forest District]. Acta Sci Pol Silv Colendar Rat Ind Lignar. 13(3):5–18.

Bennett BM. 2015. Plantations and protected areas: A global history of forest management. Cambridge, MA: MIT Press.

Bis A. 2009. Economic analysis of coniferous silviculture in Poland. Profitability comparison between Poland and Lithuania. Swedish University of Agricultural Sciences. Master Thesis no. 129. Southern Swedish Forest Research Centre, Alnarp 2009.

Brown MJ. 2004. Forest statistics for North Carolina, 2002. Resour. Bull. SRS-68. Asheville, NC: U.S. Department of Agriculture, Forest Service, Southern Research Statio. 78 p.

BULiGL. 2020. Wielkoobszarowa inwentaryzacja stanu lasu. Wyniki III cyklu (2015-2019) [Large-scale inventory of the state of the forest. Third cycle results (2015-2019)]. Downloaded from: https://www.bdl.lasy.gov.pl/portal/wisl.

Chudy R, Chudy KA, Kanieski da Silva B, Cubbage FW, Rubilar R, Lord R. 2020. Profitability and risk sources in global timberland investments. For Policy Econ. 111. doi:10.1016/j.forpol.2019.102037.

Chudy R, Cubbage FW. 2020. Research Trends: Forest investments as a financial asset class. J For Policy Econ. 119(June):1–9. doi:10.1016/j.forpol.2020.102273.

Chudy R, Stevanov M, Krott M. 2016. Strategic options for state forest institutions in Poland: evaluation by the 3L model and ways ahead. Int For Rev. 18(4). doi:10.1505/146554816820127532.

Cubbage F, Donagh P Mac, Balmelli G, Olmos VM, Bussoni A, Rubilar R, Torre RD La, Lord R, Huang J, Hoeflich VA, et al. 2014. Global timber investments and trends, 2005-2011. New Zeal J For Sci. 44(Suppl 1):2005–2011. doi:10.1186/1179-5395-44-S1-S7.

Cubbage F, Kanieski B, Rubilar R, Bussoni A, Olmos VM, Balmelli G, Donagh P Mac, Lord R, Hernández C, Zhang P, et al. 2020. Global timber investments, 2005 to 2017. For Policy Econ. 112(April 2019):102082. doi:10.1016/j.forpol.2019.102082.

Cubbage FW, Gunter JE, Olson JT. 1991. Reforestation economics, law, and taxation. Springer, Dordrecht. p. 9–31.

Dangerfield CW, Edwards MB. 1991. Economic comparison of natural and planted regeneration of loblolly pine. South J Appl For. 15(3):125–127. doi:10.1093/sjaf/15.3.125.

DGLP. 2020. Sprawozdanie finansowo-gospodarcze za 2019 rok. Dyrekcja Generalna Lasów Państwowych [Financial and economic report 2019. General Directorate of State Forests]. Downloaded from: https://www.lasy.gov.pl/pl/informacje/publikacje/informacje-statystyczne-i-r.

Długosiewicz J, Zając S, Wysocka−Fijorek E. 2019. Ekonomiczna efektywność naturalnego i sztucznego odnowienia drzewostanów sosnowych w Nadleśnictwie Nowa Dęba [Economic efficiency of natural and artificial regeneration of pine stands in the Nowa Dęba Forest District]. Sylwan. 163(5):373−384. doi:10.26202/sylwan.2018124.

Evans MC, Carwardine J, Fensham RJ, Butler DW, Wilson KA, Possingham HP, Martin TG. 2015. Carbon farming via assisted natural regeneration as a cost-effective mechanism for restoring biodiversity in agricultural landscapes. Environ Sci Policy. 50:114–129. doi:10.1016/j.envsci.2015.02.003.

Faustmann M. 1849. Berechnung des Werthes, welchen Waldboden, sowie noch nicht haubare Holzbestände für die Waldwirthschaft besitzen [Calculation of the value which forest land and immature stands possess for forestry]. Allgemeine Forst- und Jagd-Zeitung, Dec. 1849, 441-451.

FRED. 2019. Foreign exchange rates and US consumer price index. Available from: https://fred.stlouisfed.org/.

Gustafsson L, Bauhus J, Asbeck T, Augustynczik ALD, Basile M, Frey J, Gutzat F, Hanewinkel M, Helbach J, Jonker M, et al. 2020. Retention as an integrated biodiversity conservation approach for continuous-cover forestry in Europe. Ambio. 49(1):85–97. doi:10.1007/s13280-019-01190-1.

James NDG. 1996. A history of forestry and monographic forestry literature in Germany, France and the United Kingdom. In: McDonald P, Lassoie J, editors. The Literature of Forestry and Agroforestry. New York: Cornell University Press. Ithaka. p. 15–44.

Johann E. 2006. Historical development of nature-based forestry in Central Europe. In: Diaci J, editor. Nature-based forestry in Central Europe. Alternatives to industrial forestry and strict preservation. Studia Forestalia Slovenica Nr. 126. Ljubljana: University of Ljubljana. p. 178.

Kaliszewski A. 2018. Cost analysis of artificial and natural oak regeneration in selected forest districts. For Res Pap. 78(4):315–321. doi:10.1515/frp-2017-0035.

Kancelaria Sejmu. 1991. Ustawa z dnia 28 września 1991 r. o lasach [Act of September 28, 1991 on forests] (Dz.U. z 2020 r. poz. 6).

Kuuluvainen T, Lindberg H, Vanha-Majamaa I, Keto-Tokoi P, Punttila P. 2019. Low-level retention forestry, certification, and biodiversity: case Finland. Ecol Process. 8(1). doi:10.1186/s13717-019-0198-0.

Lula M, Trubins R, Ekö PM, Johansson U, Nilsson U. 2021. Modelling effects of regeneration method on the growth and profitability of Scots pine stands. Scand J For Res. 36(4):263–274. doi:10.1080/02827581.2021.1908591.

Möhring B. 2001. The German struggle between the “Bodenreinertragslehre” (land rent theory) and “Waldreinertragslehre” (theory of the highest revenue) belongs to the past - But what is left? For Policy Econ. 2(2):195–201. doi:10.1016/S1389-9341(01)00049-1.

North Carolina Forest Service. 2020. FDP prevailing rates, 2020. Available from: https://www.ncforestservice.gov/managing_your_forest/pdf/FDPPrevailingRates2019_2020.pdf. [accessed 31 December 2020].

Oswalt SN, Smith WB, Miles PD, Pugh SA. 2014. Forest resources of the United States, 2012: a technical document supporting the Forest Service 2015 update of the RPA Assessment. Gen. Tech. Rep. WO-91. Washington, DC: U.S. Department of Agriculture, Forest Service, Washington Office. 218 p.

Paluš H, Krahulcov M, Parobek J. 2021. Assessment of forest certification as a tool to support forest ecosystem services. Forests. 12(300):1–16. doi:10.3390/f12030300.

Piekutin J, Kłapeć B, Orzechowski M. 2015. Density of forest road network – economic point of view. Sylwan. 159(3):179−187.

Prestemon JP, Abt RW. 2002. Timber products supply and demand. p. 299-325. In: Southern Forest Resource assessment. Gen. tech. rep. SRS-53. Asheville, NC: USDA Foest Service, Southern Research Station.

Siry JP, Newman DH. 2001. A Stochastic production frontier analysis of Polish State Forests. For Sci. 47(4):526–533. doi:10.1093/forestscience/47.4.526.

Siry JP, Robison DJ, Cubbage FW. 2004. Economic returns model for silvicultural investments in young hardwood stands. Southern Journal of Applied Forestry 28(4):179-184.

State Forests. 2019. Portal Leśno-Drzewny [Forest and Timber Portal]. Informacja o sprzedaży wybranych grup sortymentów drewna w nadleśnictwach w latach 2015-2019 [Information on the sale of selected groups of wood assortments in forest districts in 2015-2019]. Available from: http://drewno.zilp.lasy.gov.pl/drewno/.

Statistics Poland. 2019. Statistical Yearbook of Forestry. Available from: https://stat.gov.pl/obszary-tematyczne/rolnictwo-lesnictwo/lesnictwo/.

TimberMart-South. 2020. Timber and timberland market data. Also available at North Carolina Cooperative Extension. Available from: http://www.timbermart-south.com/.

World Bank. 2019. Consumer price index (2010 = 100). International Monetary Fund. Available from: https://data.worldbank.org/.

Zając S, Kaliszewski A. 2014. Ekonomiczne aspekty ekologizacji zagospodarowania lasu [Economic aspects of ecological forest management] Prezentation during VI Sesja Zimowej Szkoły Leśnej, Sękocin Stary, 18-20 marca 2014 r.

FOOTNOTES

[1] We use artificial regeneration and tree planting terms interchangeably through the paper, as opposed to natural regeneration. By natural regeneration, we mean a partial felling method such as individual tree selection, shelterwood, or leaving seed trees; or regeneration after clear felling from residual small saplings, seeds, or sprouts from roots.

[2] The literature evidence on natural regeneration costs of Scots pine came from studies of Bis (2009), Długosiewicz et al. (2019), Zając and Kaliszewski (2014). For oak spp., we used the data from Kaliszewski (2018)(Kaliszewski 2018), where the cost analysis of artificial and natural oak regeneration was conducted, and we found it representative.

[3] Biological rotation age is optimized for long-term timber volume production determined by the stand age when mean annual increment of volume growth and periodic annual increment are equal or very close to each other.

[4] Economical rotation age – or sometimes called financially optimal rotation length – maximizes the net present value or land expectation value by discounting costs and revenues to present value with a chosen discount rate. In other words, the optimal time to cut the forest is when the time rate of change of its value is equal to interest on the value of the forest plus the interest on the value of the land (Faustmann 1849)(Faustmann 1849).

[5] These inputs came from studies of Adamowicz and Kaciunka (2014), Ankudo-Jankowska and Tutka (2014), DGLP (2020), Piekutin et al. (2015).

[6] TIMOs or REITs in the U.S., who manage a significant portion of pine plantations, do use rotation ages around 25 years for loblolly pine. Hardwoods are seldom managed as plantations, but planted and natural rotations tend to be 80 years or more. This age, however, would not represent a financial optimum since the long wait for final harvest revenues would not be worth the extra volume grown. So we chose 60 years as an approximated financial optimum for our analyses.

[7] There were no reported hardwood plantations.

[8] Poland has mandated rotation ages that largely do use even aged management.

[9] Template is available online as a supplementary material to the article published by Cubbage et al. (2014), or available from the authors.

[10] We applied a uniform 5% real discount rate to estimate returns for all species in both countries. Such fixed discount rate allowed us to compare all investments on the same basis, without the cost of land that in both countries is different. The fixed discount rate also helped us to keep the baseline for consistency for every year that the research data have been collected.

[11] 1 basis point (bp) = 0.01%

[12] The results indicate one reason for preferring NPV or LEV over IRR in capital budgeting with a known discount rate, especially in forest investments with sufficient capital. Lower discount rates allow more expensive planted forest investments to generate higher total profits, even though their IRR may be less than natural forests. As noted, IRRs also may have mathematical calculation problems in investments with multiple cash flows that alternate in signs, leading to multiple IRRs.

[13] Chudy et al. (2020) did not include U.S. hardwoods.